Green compliance and emerging market layout are becoming the dual engines for Chinese polypropylene enterprises to cross trade barriers.

On July 10, US President Trump signed an executive order to extend the 90-day suspension period of “reciprocal tariffs” to August 1. However, this extension does not include China, and the final result of the trade game between the two countries is still to be revealed in the August dialogue13.

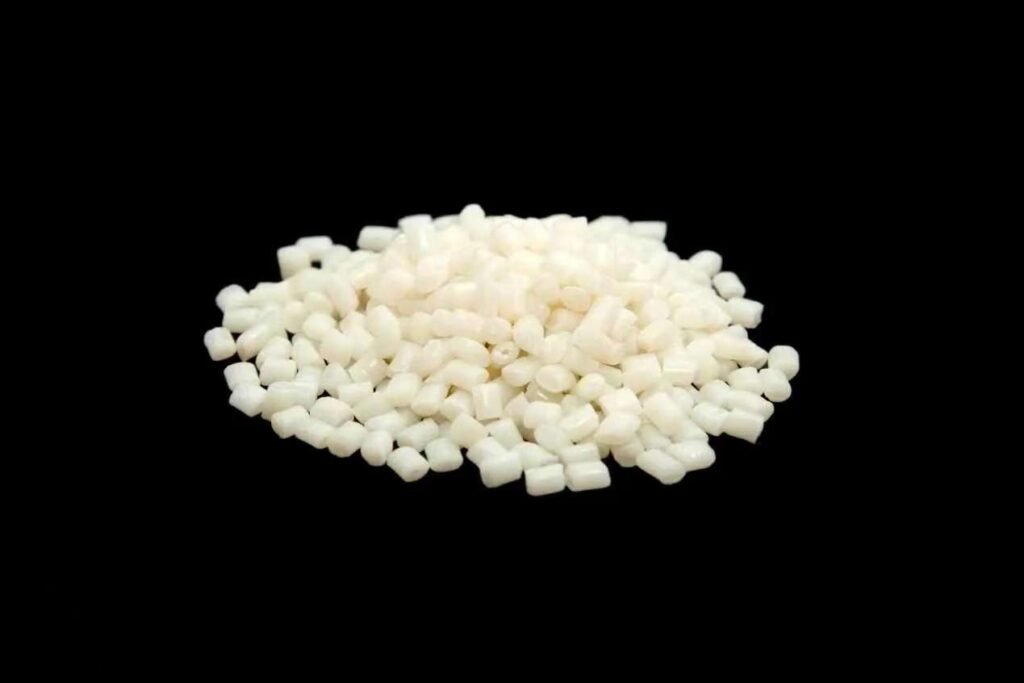

Against the background of this unresolved policy, China’s polypropylene plastic granule export market is undergoing complex changes. Data as of July 10 showed that PP downstream product orders fell by 1.19% month-on-month. Although there was a year-on-year increase of 16.10%, the combination of weak overseas demand and off-season effects put short-term exports under pressure1.

01 Market status under the shadow of tariffs

The tariff game between China and the United States continues to escalate. In April this year, the United States announced a “reciprocal tariff” of 125% on Chinese goods exported to the United States, and China immediately retaliated with the same tariff rate2.

This policy has a substantial impact on the polypropylene industry chain. Taking the plastic weaving industry as an example, the export volume in February 2025 fell by 3.18% year-on-year, of which exports to the United States accounted for 11.08%, and tariff costs significantly compressed corporate profit margins2.

Some companies that rely on the US market face a dilemma: exports are almost unprofitable, and switching to domestic sales intensifies domestic competition. The head of a BOPP company admitted that “high tariffs have made US orders tasteless, but giving up means losing long-term customers”2.

02 Differentiation trends in sub-sectors

The various sub-sectors of polypropylene products present a “two-faced” situation:

BOPP film: The food printing industry has entered the off-season, the intention to replenish stocks is sluggish, and the number of order days has decreased by 1.7% month-on-month. The demand for beverage bottle label film is still there due to high temperature weather, but the overall export orders have shrunk1

CPP packaging film: Domestic clothing and printing industry demand is weak, but Southeast Asian e-commerce and beverage industry demand has surged, driving exports to Southeast Asia to grow year-on-year1

PP non-woven fabrics: Demand for sanitary products has declined, but demand in the medical field is stable. Demand in Asia, the Middle East and Africa has grown significantly, becoming a new growth point for exports1

PP pipes: The domestic operating rate has slightly dropped to 36.33%, but the infrastructure boom in Southeast Asia has driven exports, and 5G and high-speed rail projects in Indonesia and Malaysia have spawned demand for high-performance pipes1

03 Southeast Asian market has become a key breakthrough

When traditional European and American markets are restricted by tariffs, Southeast Asia is becoming a “golden corridor” for polypropylene exports.

The surge in demand for CPP packaging in Southeast Asia’s e-commerce and beverage industries has driven a significant increase in China’s exports to the region1. Indonesia, Malaysia and other countries have simultaneously increased their demand for high-performance pipes in the promotion of 5G, smart cities and high-speed rail projects1.

This trend has a synergistic effect with China’s “Belt and Road” initiative. Some large pipe companies have adopted the strategy of “building factories overseas” to avoid high shipping costs and enhance regional competitiveness by setting up production bases in Southeast Asia1

04 Green transformation: from compliance pressure to competitive weapon

In 2025, global environmental regulations will take effect intensively, forcing the polypropylene industry to upgrade:

Germany’s Single-Use Plastics Law: Enforced from January 1, 2025, requiring manufacturers to register on the German Environment Agency DIVID platform, and Amazon will forcibly remove non-compliant products from the shelves57

Circular Economy Certification: The international recycling standard GRS certification has become a “green pass” for exporting to Europe, and certified products can enjoy tariff reductions4

The practice of Wenzhou Wobo Stationery has proved the commercial value of green transformation. The company uses marine plastic bottles collected by the “Blue Sea Station” to produce environmentally friendly rulers, and successfully entered the European high-end market after passing the GRS certification.

“Environmental protection is not only a pass, but also a magic weapon for winning,” said Zhao Wenya, general manager of the company. “Products exported to Europe and the United States enjoy tariff reductions, and even if the retail price is higher than that of ordinary plastic rulers, consumers still pay for it”4.

05 Enterprises’ multi-dimensional breakthrough strategies

Faced with a complex trade environment, leading enterprises have launched multi-dimensional breakthroughs:

Globalization of production layout: Establishing production bases in Southeast Asia, Mexico and other places, building a “regional manufacturing center + localized production” network, and avoiding tariff barriers6

Product high-end transformation: Developing high-performance transparent PP, automotive modified PP and other high-value-added products to get rid of low-price competition1

Circular technology breakthrough: For example, Wobo Stationery innovatively solves the problem of whitening of recycled PET materials, realizing the transformation from “marine plastic” to high-end stationery4

Policy dividend capture: China’s home appliance trade-in and automobile subsidy policies drive demand for modified PP, and enterprises adjust the proportion of domestic sales to hedge export risks1

06 Future Outlook: Short-term pressure and long-term opportunities

In the short term, the polypropylene market still faces challenges. Transparent polypropylene is suppressed by the escalation of Sino-US tariffs and global trade uncertainties, showing a volatile pattern of “increased supply, weak demand, and slightly reduced inventory”1.

But there may be a turnaround at the end of the third quarter. As the traditional “golden September and silver October” peak season approaches, and the third batch of national subsidies will be issued in July, the policy of replacing old cars and home appliances with new ones is expected to boost demand for modified PP, capacitor film and other products1.

More far-reaching changes are taking place. Stricter global environmental regulations are driving innovation in recycled polypropylene technology. At the same time, infrastructure construction and consumption upgrades in emerging markets such as Southeast Asia, the Middle East and Africa provide new outlets for China’s polypropylene production capacity16.

With the peak demand season of golden September and silver October approaching, the polypropylene market may see a turnaround. The third batch of national subsidies will be issued in July, and the policy of replacing old cars and home appliances with new ones will continue to support demand for high-end materials such as modified PP1.

The implementation of the German disposable plastics law next year will become a weathervane for global environmental regulations. Companies like Wobo Stationery that turn green challenges into brand advantages are proving that sustainable innovation is not only a compliance cost, but also a key leap for China’s manufacturing to shift from price competition to value competition.